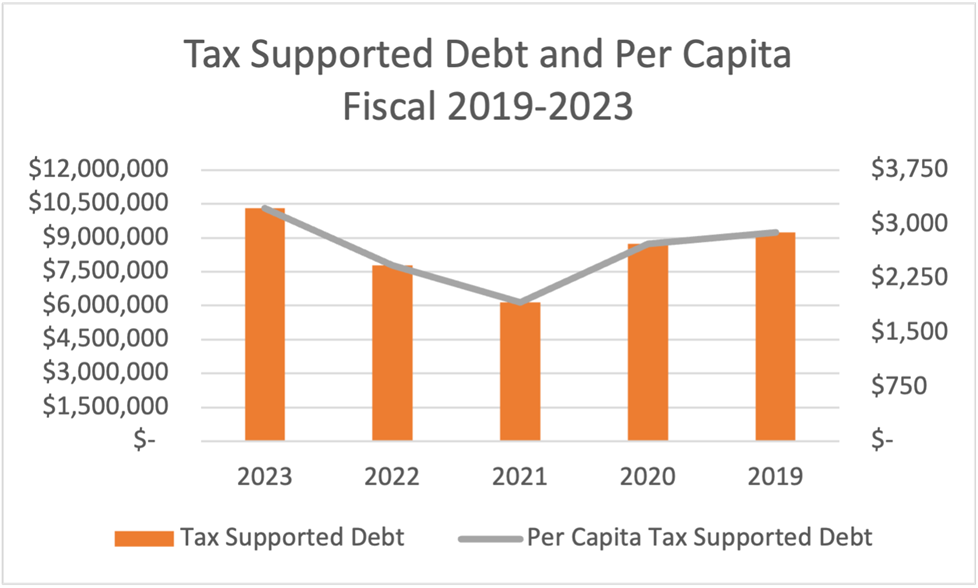

The City of Hudson Oaks has outstanding tax supported debt, revenue supported debt and capital leases. The amount of tax supported debt outstanding at September 30, 2023 is $10,298,750, revenue supported debt is $4,960,050 and capital leases of $25,450. The City of Hudson Oaks tax supported debt and revenue supported debt have been rated AA Stable by Standard & Poor's Ratings Services.

Per Capital figures based on a 2023 estimated population of 3,200.

Historical Debt Authorization and Approval

The City's debt is comprised of certificates of obligations and one general obligation refunding bond, all of which did not require voted approval. The outstanding debt was authorized as follows:

Combination Tax and Revenue Certificates of Obligation, Series 2007

On October 25, 2007, the City authorized the issuance and sale of $1,800,000 Combination Tax and Revenue Certificates of Obligation, Series 2007. The certificates were issued for paying, in whole or in part, the City’s contractual Obligations incurred to acquire and construct street, bridge, curb, and sidewalk improvements, together with utility relocation and drainage improvements incidental thereto, pay for professional services rendered in connection therewith and paying for costs of issuance.

Combination Tax and Revenue Certificates, Series 2016A

On May 5, 2016, the City authorized the issuance and sale of $4,745,000 Combination Tax and Revenue Certificates of Obligation, Series 2016A dated June 1, 2016. The Certificates were issued in order to raise the necessary funds for the City portion of the IH-20 Interchange at CenterPoint Road, the upcoming Oykey Corridor development and overages in the Lakeshore Bridge project.

Combination Tax and Revenue Certificates, Series 2016B

On May 5, 2016, the City authorized the issuance and sale of $1,540,000 Combination Tax and Revenue Certificates of Obligation, Series 2016B dated June 1, 2016. The Certificates were issued in order to raise the necessary funds for improvements to the City’s infrastructure fiber internet system.

Certificates of Obligation, 2018

On March 22, 2018, the City authorized the issuance and sale of $2,325,000 Certifications of Obligations. The Certificates were issued for the construction of City fiber lines and for the creation of Public Improvement District No. 1.

General Obligations Refunding Bond, 2020

The purpose of this issuance is to provide funds to refund a portion of the City’s General Obligation indebtedness and pay for costs of issuance (General Obligation Bond 2010).

General Obligation Refunding Bond 2021A

On March 10, 2021, the City Authorized the issuance and sale of $2,380,000 Texas General Obligation Refunding Bond dated May 3, 2021. The purpose of this issuance is to provide funds to refund a portion of the City’s General Obligation indebtedness and pay for costs of issuance (Texas Certificates of Obligation Series 2012 & Texas Combination Tax and Limited Pledge revenue Certificate of Obligation Series 2014).

General Obligation Refunding Bond 2021B

On March 10, 2021 the City Authorized the issuance and sale of $1,330,000 000 Texas General Obligation Refunding Bond dated May 3, 2021. The purpose of this issuance is to provide funds to refund a portion of the City’s General Obligation indebtedness and pay for costs of issuance (Texas Combination Tax and Revenue Certificates of Obligation Series 2016B).

Certificates of Obligations, 2023

On April 27, 2023, the City authorized the issuance and sale of $4,810,000 Combination Tax and Revenue Certificates of Obligation dated April 15, 2023. The Certificates were issued to finance the construction, acquisition, and equipping of improvements to the City’s utility system.

The City of Hudson Oaks currently does not have an ad valorem tax. Even though all the debt is backed by an ad valorem tax, the City does not levy one. Surplus revenues generated by sales tax and revenue by the various water and wastewater systems support the outstanding debt.

Fort Worth Waterline Debt

The City has an agreement with the City of Willow Park that holds the City responsible for 48% of the debt issued for the construction of the City of Fort Worth waterline (2019 Certificates of Obligation and 2021 Certificates of Obligation).

The City of Hudson Oaks currently does not have an ad valorem tax. Even though all the debt is backed by an ad valorem tax, the City does not levy one. Surplus revenues generated by sales tax and revenue by the various water and wastewater systems support the outstanding debt.

Bond Compliance Requirements

Bond restrictions demand the City must create and maintain certain accounts or funds to receive the proceeds from the sale of the bonds and to account for the revenues which are pledged for payment of the bonds. The assets can be used only in accordance with the terms of the bond ordinance and for the specific purpose(s) designated therein.

The City is generally required to make an annual transfer to debt service funds equal to the next interest and principal payment. The bonds may be redeemed prior to their maturities in accordance with the bond ordinances in whole or in part in principal amounts of $5,000 or any integral multiple thereof. During FY 2023 the City has complied with the requirements of all bond ordinances and related bond restrictions.

Legal Debt Margin

There is no statutory debt limitation in the City Charter or under State law. The City Charter provides that the total debt of the City shall not exceed that provided by state law. Under the provisions of State law (Article XI, Section 5, of the State of Texas Constitution), the maximum tax rate is limited to $2.50 per $100 assessed valuation. The City currently does not levy an ad valorem tax. Debt service to total general expenditures for fiscal year ending September 30, 2023 was 10.87%.

Continuing Disclosure Report

The Municipal Securities Rulemaking Board’s (MSRB) Electronic Municipal Market Access (EMMA) website publicly displays continuing disclosures that are provided either as required disclosures by municipal issuers and other parties known as “obligated persons” or “obligors” under contractual agreements entered into under Rule 15c2-12 of the Securities Exchange Act of 1934 (Exchange Act) or as voluntary disclosures by issuers and obligated persons without a contractual obligation to do so. Continuing disclosure consists of important information about a municipal bond that arises after the initial issuance of the bond. This information generally would reflect the financial or operating condition of the issuer as it changes over time, as well as specific events occurring after issuance that can have an impact on the ability of issuer to pay amounts owing on the bond, the value of the bond if it is bought or sold prior to its maturity, the timing of repayment of principal, and other key features of the bond.

Resources